Although the S&P 500 is down 1.7% over the past six months, Lyft’s stock price has fallen further to $11.57, losing shareholders 7.7% of their capital. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy LYFT? Find out in our full research report, it’s free.

Why Does Lyft Spark Debate?

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Two Positive Attributes:

1. Active Riders Drive Additional Growth Opportunities

As a gig economy marketplace, Lyft generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

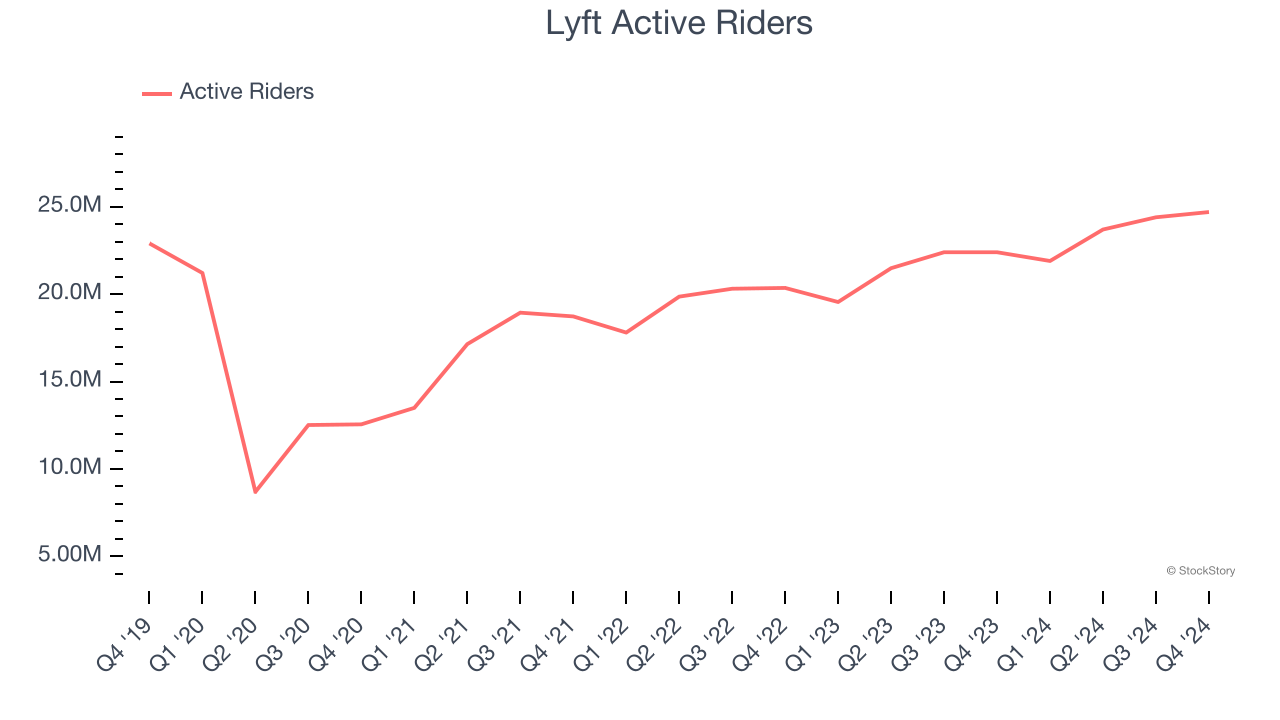

Over the last two years, Lyft’s active riders, a key performance metric for the company, increased by 10% annually to 24.7 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

2. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

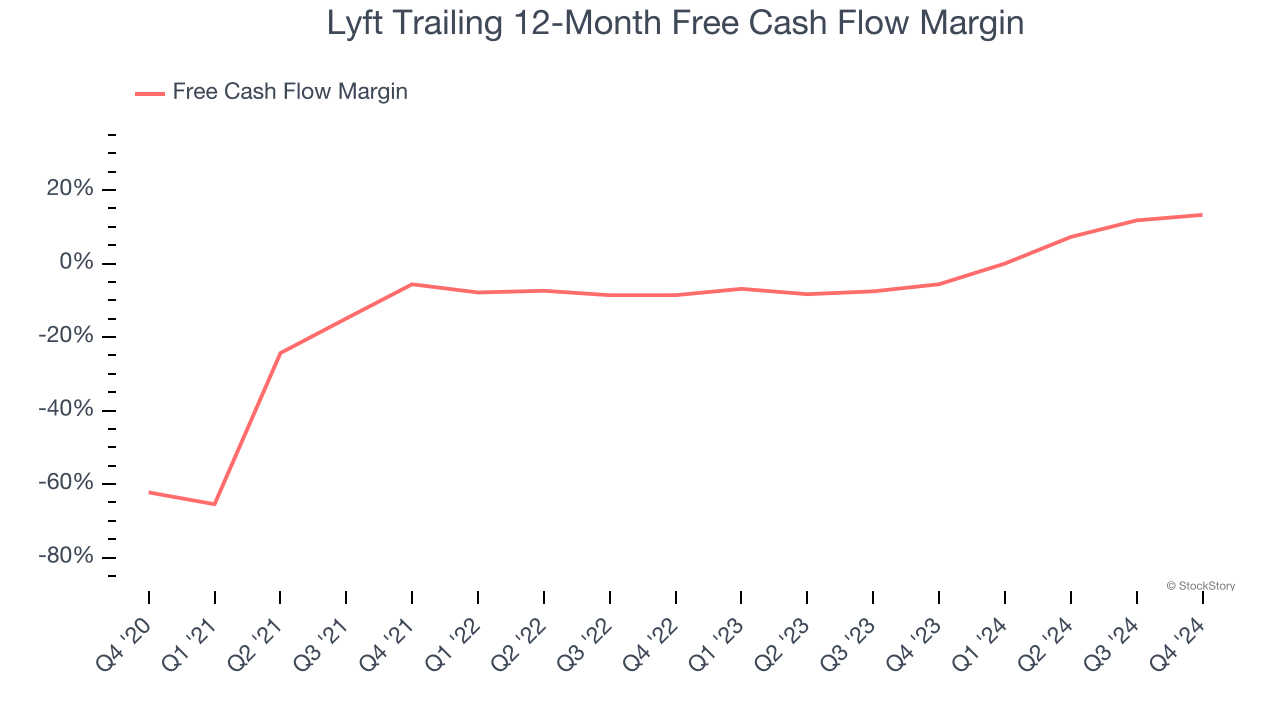

As you can see below, Lyft’s margin expanded by 18.9 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Lyft’s free cash flow margin for the trailing 12 months was 13.2%.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

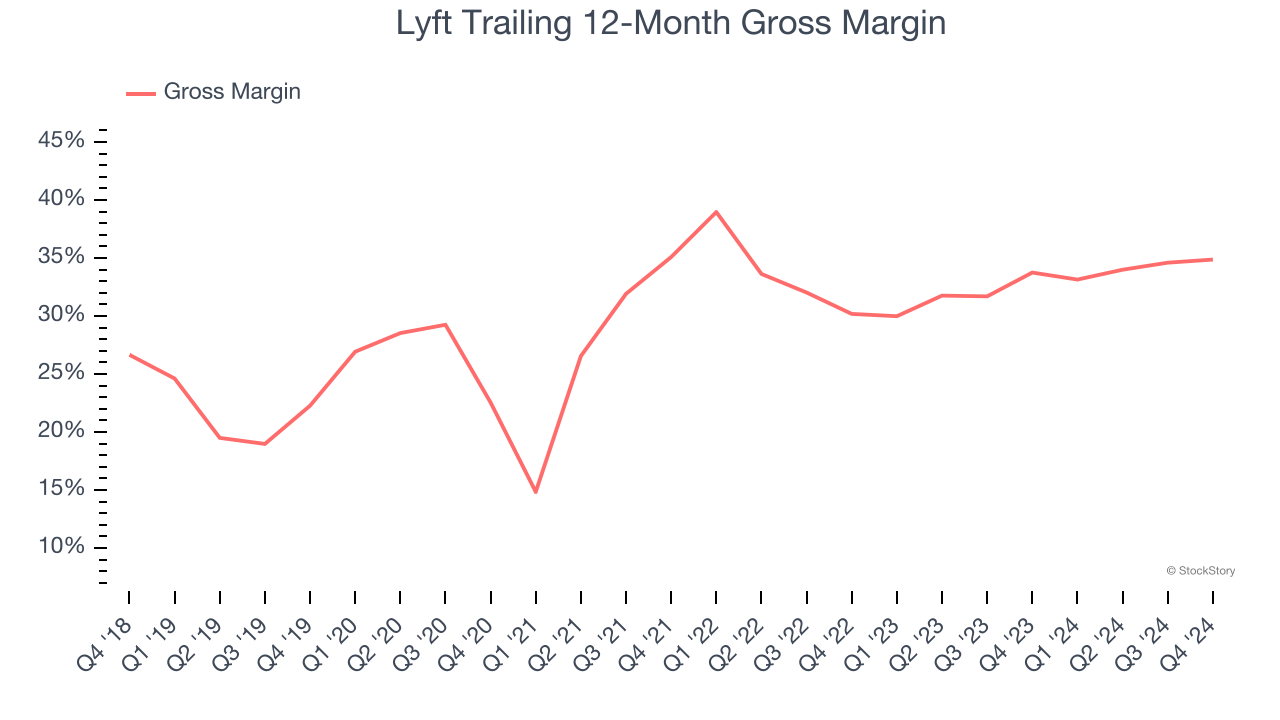

For gig economy businesses like Lyft, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include server hosting, customer support, and payment processing fees. Another cost of revenue could also be insurance to protect against liabilities arising from providing transportation, housing, or freelance work services.

Lyft’s unit economics are far below other consumer internet companies, signaling it operates in a competitive market and must pay many third parties a slice of its sales to distribute its products and services. As you can see below, it averaged a 34.4% gross margin over the last two years. Said differently, Lyft had to pay a chunky $65.61 to its service providers for every $100 in revenue.

Final Judgment

Lyft’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 9.8× forward EV-to-EBITDA (or $11.57 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Lyft

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.