News

The Nasdaq‑100 Index ETF has completed the cycle that began from the April 7, 2025 low, and the instrument is now entering a larger‑degree corrective phase.

Via Talk Markets · February 13, 2026

For three years, the Schwab U.S. Dividend Equity ETF has badly lagged the S&P 500. That all changed in 2026.

Via The Motley Fool · February 12, 2026

In a conversation with ProCap’s Anthony Pompliano, Barry Silbert said he remains bullish on Bitcoin but does not expect 500x returns from current levels.

Via Stocktwits · February 12, 2026

Explore how these two leading ETFs differ in diversification and portfolio structure for consumer staples investors.

Via The Motley Fool · February 12, 2026

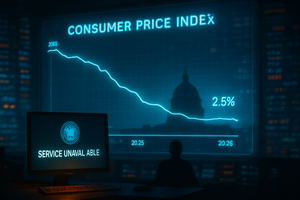

Among the key catalysts for Friday is the release of U.S. January consumer price index data.

Via Stocktwits · February 12, 2026

Explore how these two short-term bond ETFs differ in risk, yield, and portfolio makeup for investors seeking stability or diversification.

Via The Motley Fool · February 12, 2026

The Invesco QQQ is one of the most popular ETFs on the market. But is it the best growth-oriented ETF?

Via The Motley Fool · February 12, 2026

Explore how differences in yield, holdings, and sector mix set these two low-cost small-cap ETFs apart for investors.

Via The Motley Fool · February 12, 2026

VXUS is an easy way to gain exposure to overseas markets.

Via The Motley Fool · February 12, 2026

The iShares Bitcoin Trust ETF and the VanEck Bitcoin ETF both offerdirect bitcoin exposure, but one dominates in scale and the other offers a fee advantage. Here’s what matters most when choosing between these leading bitcoin ETFs.

Via The Motley Fool · February 12, 2026

Thursday’s notes from the trade desk of Senior Market Strategist John Rowland, CMT.

Via Barchart.com · February 12, 2026

Democrats on Thursday blocked a Republican-backed measure to secure votes to fund the Department of Homeland Security beyond the Feb. 13 midnight deadline.

Via Stocktwits · February 12, 2026

The enterprise software market is currently grappling with a seismic shift that many are calling the "Software Sector Apocalypse" or the "SaaSpocalypse." As of mid-February 2026, a massive rotation out of legacy software-as-a-service (SaaS) names has wiped hundreds of billions of dollars from the market. Investors, once enamored by the

Via MarketMinute · February 12, 2026

An ETF launched by Tom Lee in 2024 focusing on investment themes has eight stocks shared in common with the Dow Jones Industrial Average. A look at the stocks.

Via Benzinga · February 12, 2026

In a year when OpenAI, Anthropic, and SpaceX could all go public, this IPO-focused fund deserves a look.

Via The Motley Fool · February 12, 2026

Wedbush says that ServiceNow is a "stalwart" in the AI revolution.

Via Barchart.com · February 12, 2026

The top Bitcoin ETF is a simple way to invest in the top cryptocurrency.

Via The Motley Fool · February 12, 2026

XRP (CRYPTO: XRP) has gained 9% over the past seven days, outperforming much of the broader crypto market, as institutional developments and ecosystem upgrades boosted

Via Benzinga · February 12, 2026

From risk profiles to underlying assets, these two ETFs take sharply different paths to precious metals exposure.

Via The Motley Fool · February 12, 2026

America's largest technology stocks continue to fuel blistering returns in the Nasdaq-100 index.

Via The Motley Fool · February 12, 2026

Texas Pacific Land stock has lagged behind the broader market over the past year, but analysts remain fairly bullish about its prospects.

Via Barchart.com · February 12, 2026

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

LONDON/NEW YORK – In a historic shift that has redefined the global financial landscape, gold has decisively breached the $5,000 per ounce milestone for the first time in history. As of February 12, 2026, the yellow metal sits at $4,985, having briefly peaked at a staggering $5,608

Via MarketMinute · February 12, 2026

In a move that signals the dawn of a new era for independent energy producers, Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) announced a definitive $58 billion merger agreement on February 2, 2026. This all-stock "merger of equals" is designed to create a premier large-cap shale operator, specifically

Via MarketMinute · February 12, 2026

Although Allstate has trailed the S&P 500 over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

Via Barchart.com · February 12, 2026