Currency News

The Pound Sterling faces slight selling pressure as the BoE is widely expected to cut interest rates in May.

Via Talk Markets · April 29, 2025

The EUR/GBP cross extends its downside to near 0.8490 during the early European session on Tuesday. The Euro (EUR) softens against the Pound Sterling (GBP) due to the dovish remarks from the European Central Bank (ECB).

Via Talk Markets · April 29, 2025

The Australian Dollar (AUD) is edging lower on Tuesday after registering more than 0.50% gains against the US Dollar (USD) in the previous session.

Via Talk Markets · April 29, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Monday, April 28.

Via Talk Markets · April 28, 2025

The EUR/USD pair edges lower to near 1.1415 during the early Asian session on Tuesday. The Euro (EUR) weakens against the US Dollar (USD) amid rising bets for further rate cuts from the European Central Bank (ECB) in June.

Via Talk Markets · April 28, 2025

Stocks came in wobbly, and went up and down in their usual willful way. Gold and silver sustained an early smackdown, but in the end gained some ground.

Via Talk Markets · April 28, 2025

The US Dollar (USD) weakens slightly on Monday as markets kick off a busy week, overshadowed by skepticism surrounding United States (US) trade policy.

Via Talk Markets · April 28, 2025

Mexican Peso weakens 0.48% even as Mexican labor market and trade data surprise to the upside.

Via Talk Markets · April 28, 2025

USD/JPY tumbles during North American trading, hovering near the bottom of its daily range around 142.00.

Via Talk Markets · April 28, 2025

It was an interesting day in FX, with the yen strengthening by more than 1% against the dollar and the Swiss franc gaining 80 bps.

Via Talk Markets · April 28, 2025

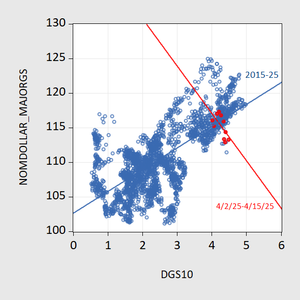

In the two weeks around Liberation Day, Treasury 10 year yields rose as the dollar fell.

Via Talk Markets · April 28, 2025

The US Dollar flatlines while traders keep calm ahead of a pivotal week in US data.

Via Talk Markets · April 28, 2025

The EUR/USD forecast shows a softer euro due to increasing ECB rate cut bets.

Via Talk Markets · April 28, 2025

The US dollar is trading quietly in a mixed fashion, mostly confined to the ranges seen at the end of last week.

Via Talk Markets · April 28, 2025

FTSE is inches higher ahead of UK banks’ earnings this week. EUR/USD falls away from its 3-year high ahead of a busy week.

Via Talk Markets · April 28, 2025

Asian markets opened the week on a stable footing as investors awaited updates on US trade negotiations with the region.

Via Talk Markets · April 28, 2025

Market participants should carefully monitor wave C’s characteristics, looking for sustained momentum and a clear progression.

Via Talk Markets · April 28, 2025

NZD/USD falls as the US Dollar gains strength, following China’s decision to exempt certain US imports from its 125% tariffs.

Via Talk Markets · April 28, 2025

The USD/JPY exchange rate has rebounded in the past few days.

Via Talk Markets · April 28, 2025

EUR/USD turns sideways around 1.1350 as investors look for fresh cues on trade relations between the US and China.

Via Talk Markets · April 28, 2025

Stocks have rebounded over the last three weeks from the initial shock of the “liberation day” tariffs announced.

Via Talk Markets · April 28, 2025

Markets will be watching the result of a closely contested Federal election in Canada today, with the governing Liberal Party narrowly ahead in final opinion polls.

Via Talk Markets · April 28, 2025

After being bounced around by a devastating month of tariff news, the path for FX markets will be determined by hard US data this week.

Via Talk Markets · April 28, 2025

Markets grabbed a tactical lifeline last week as the White House pulled back from the brink. The market’s stopped panicking, but it hasn’t started trusting.

Via Talk Markets · April 27, 2025

For nearly eight decades the U.S. dollar has worn the crown of global commerce - pricing oil, anchoring central-bank reserves, and underwriting America’s unrivaled borrowing binge.

Via Talk Markets · April 27, 2025