The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how semiconductor manufacturing stocks fared in Q4, starting with IPG Photonics (NASDAQ:IPGP).

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.8% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.1% since the latest earnings results.

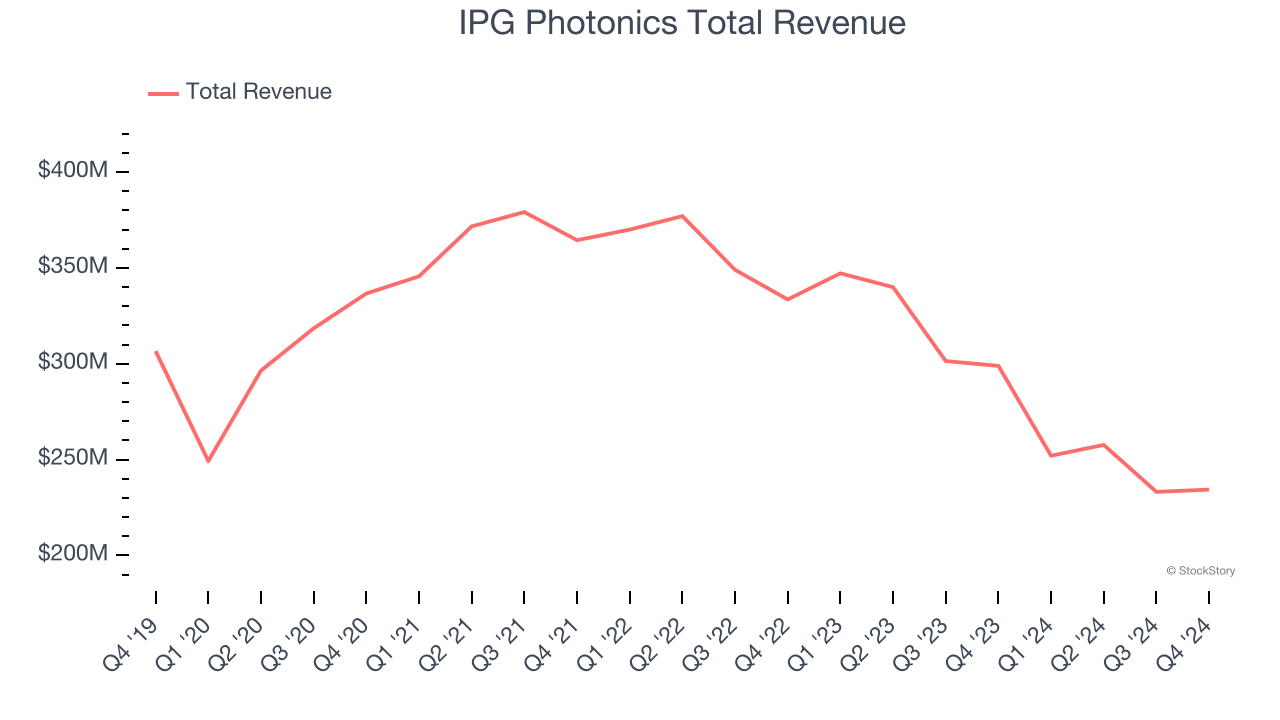

IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $234.3 million, down 21.6% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

IPG Photonics delivered the slowest revenue growth of the whole group. The stock is down 3.5% since reporting and currently trades at $64.99.

Is now the time to buy IPG Photonics? Access our full analysis of the earnings results here, it’s free.

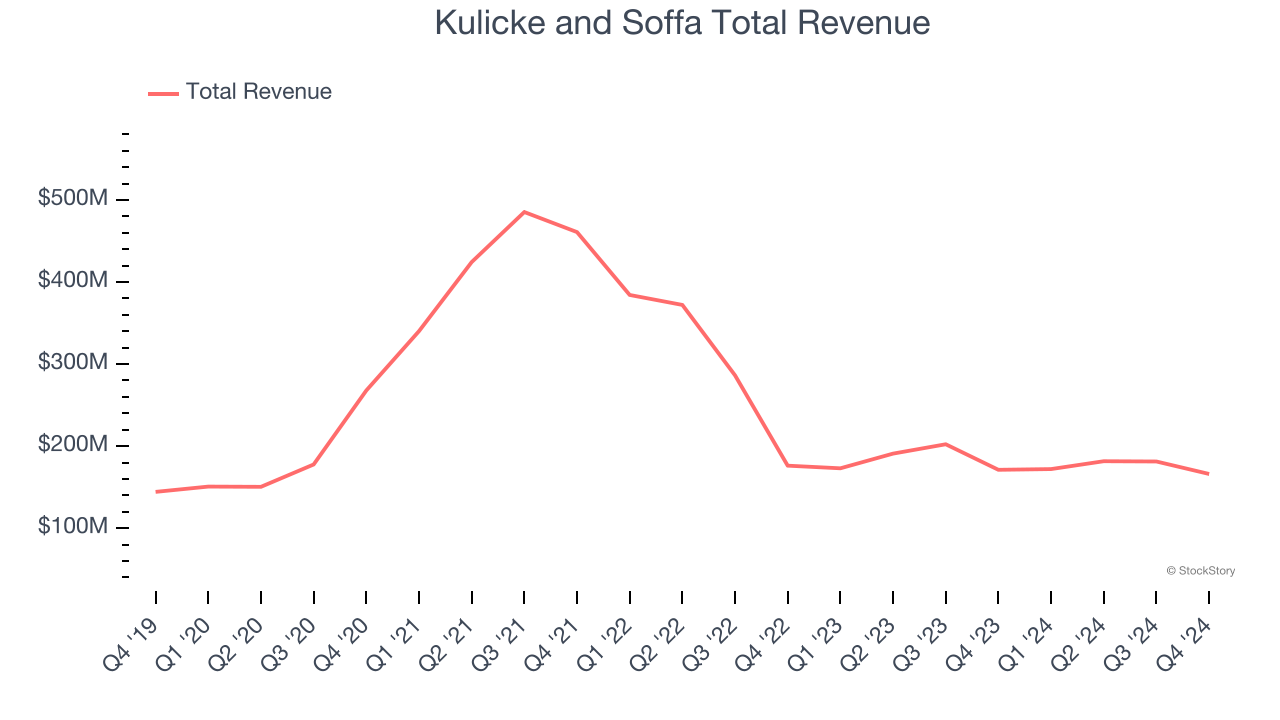

Best Q4: Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $166.1 million, down 3% year on year, outperforming analysts’ expectations by 0.7%. The business had a very strong quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 17.7% since reporting. It currently trades at $35.71.

Is now the time to buy Kulicke and Soffa? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: FormFactor (NASDAQ:FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $189.5 million, up 12.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 21.5% since the results and currently trades at $32.29.

Read our full analysis of FormFactor’s results here.

Entegris (NASDAQ:ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $849.8 million, up 4.6% year on year. This print topped analysts’ expectations by 3.3%. It was a strong quarter as it also produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 6.4% since reporting and currently trades at $97.31.

Read our full, actionable report on Entegris here, it’s free.

KLA Corporation (NASDAQ:KLAC)

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA Corporation reported revenues of $3.08 billion, up 23.7% year on year. This number surpassed analysts’ expectations by 4.5%. Overall, it was a very strong quarter as it also logged a significant improvement in its inventory levels and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 3.5% since reporting and currently trades at $717.50.

Read our full, actionable report on KLA Corporation here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.